No products in the cart.

Compliance Manager – Deposit Products

0

This listing has expired.

OPERATING HOURS

Online all the time

Office Hours: 8 AM to 8 PM

Office Hours: 8 AM to 8 PM

Sitemap | Published Press | Privacy Policy

Staff Email | Independent Media | Buy traffic for your website | Change privacy settings

OPERATING HOURS

Online all the time

Office Hours: 8 AM to 8 PM

Sitemap | Published Press | Privacy Policy

Staff Email | Independent Media

Buy traffic for your website

Change privacy settings

Office Hours: 8 AM to 8 PM

Sitemap | Published Press | Privacy Policy

Staff Email | Independent Media

Buy traffic for your website

Change privacy settings

LIVE WEBSITE VIEWERS

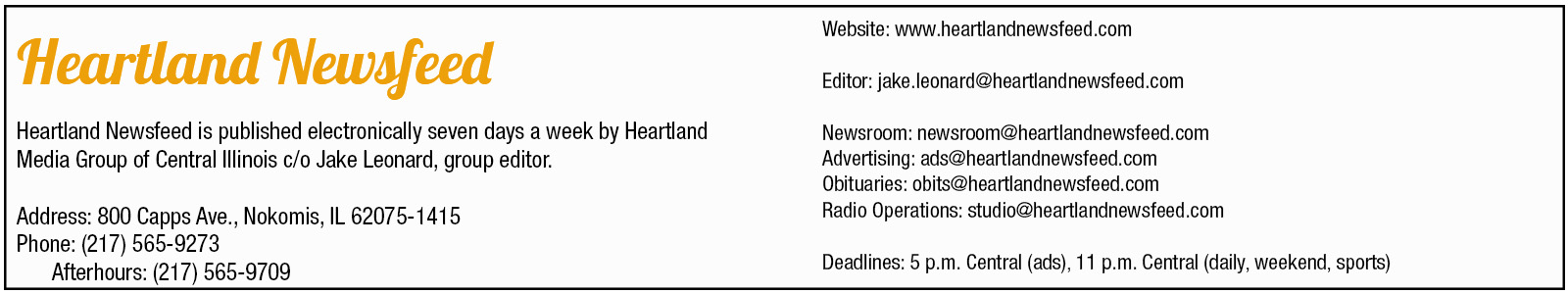

Some rights reserved 2017-2024 by Heartland Newsfeed, a Heartland Media Group of Central Illinois media property. Content published by Heartland Newsfeed staff is covered by the BipCot NoGov license. This allows use and re-use by anyone except governments and government agents. License on record. JNews theme designed and developed by Jegtheme.